The Mortgage Lender’s Economic Update – May Recap

The Mortgage Lender's Economic Update suggests a complex economic landscape.

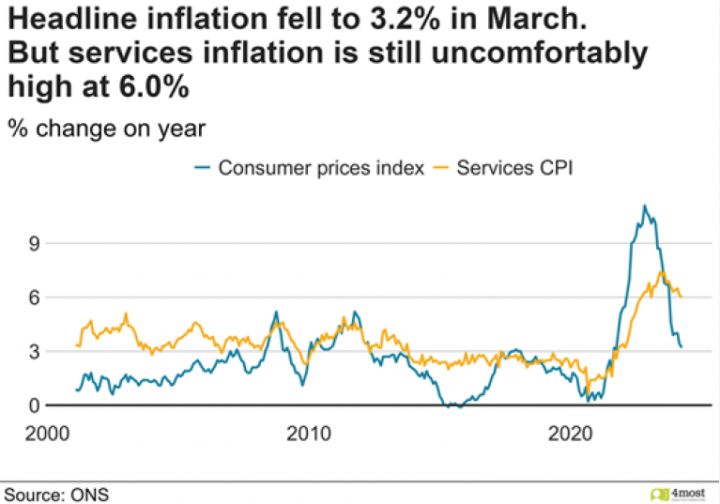

March's inflation figures fell short of expectations. Although achieving a 2% inflation rate in April remains possible, persistent inflation in the service sector may hinder early reductions in interest rates.

Even if inflation temporarily falls to 2%, sustained service sector and wage inflation have led markets to revise their expectations for rate reductions. The earliest anticipated rate cut by the Bank is now August, subject to a significant slowdown in wage growth in the coming months

Mortgage Market:

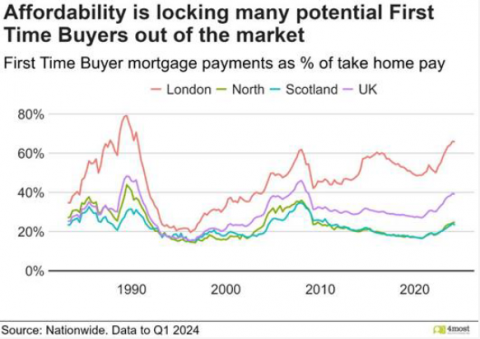

Although mortgage market activity has improved, it remains subdued. Lower interest rates, which could stimulate the market, now appear more distant than previously projected. Potential sellers are returning to the market but, stretched affordability continues to limit the number of buyers. Those who are buying often opt for shorter-term fixed-rate mortgages, hoping for lower rates in two years.

Monetary policy remains restrictive with the focal question of whether the Bank will focus on short-term inflation and wage issues or the broader economic picture. Market expectations have been volatile, but currently two 0.25% rate cuts are anticipated later this year. The expected rate cut is delayed to August (from June) pushing mortgage rate reductions further into the future.

Recently, many lenders have raised mortgage rates, a trend reflected in the increased quoted rates over the past few months. Consequently, mortgage product rates are expected to remain high in the near term. Despite this, the incentive for remortgaging remains strong, though many borrowers stay with their existing lenders.

Housing Market:

The signals in the housing market are mixed. Estate agents are optimistic about both activity and asking prices, yet quoted mortgage rates have been rising over the past three months, leading to a 0.4% decline in house prices in April, according to the Nationwide House Price Index.

Surveyors no longer expect national-level price reductions, but given the recent increase in interest rate expectations, this optimism may be premature. The weakening in First Time Buyer affordability suggests that valuations could be 20% too high. However, without widespread forced selling, significant price drops seem less likely than six months ago.

One potential source of forced selling could be Buy-to-Let landlords facing higher interest rates. Currently, the impact appears marginal, but changes in government policy could alter the landscape for Buy-to-Let. The longer high interest rates persist, the more likely it becomes that we will see an abrupt market revaluation.

Rental Market:

The view that affordability is reaching the limits in the South is supported by rental demand in London falling. Despite these affordability challenges, most surveyors have still seen rents rising. Homelet’s survey showed rents increase by 1.6% through March.

The Office of National Statistics research has shown that rent has increased by 9.2% in the year to March. With the prospect that this figure will remain high throughout the year with expiring tenancy agreements expected to be renegotiated to match the current market conditions.

The Renters Reform Bill, though watered down, was put to the House of Commons on the 24th of April. With a potential change of government in the coming months, there is uncertainty how this will impact the landscape for both renters and Buy-to-Let landlords.

For personalised advice tailored to the current economic climate, speak with our experienced mortgage consultants or call us at 01628 564631. We're here to help providing you with informed guidance every step of the way.

Your mortgage is secured on your property. Your home may be repossessed if you do not keep up repayments on your mortgage.

The information contained within was correct at the time of publication but is subject to change.

Source: The Mortgage Lender