Zoopla's December 2023 Rental Market Report Overview

Zoopla's latest report brings optimistic news for UK renters, indicating a shift past the peak rental growth phase. The expected annual growth is projected to halve to 5%, marking the lowest since 2021.

Key Insights:

- Past Peak Rental Growth: The UK is deemed to have passed its peak rental growth, with anticipated annual growth reducing to 5%, the lowest since 2021.

- Supply-Demand Disparity: Over the last three years, a substantial inequality in the private rental sector's supply and demand has led to rents increasing by a third annually, averaging £3,360.

- Anticipated Slowdown: Zoopla foresees a significant slowdown in rental growth in the coming year, particularly in markets where tenants resist further increases. This slowdown is most noticeable in London, renowned for its high rental costs, with affordability challenges influencing demand.

- Resistance to High Rents: There are early signs suggesting that in certain markets, rental prices have reached a peak with tenants are pushing back against further increases.

- London's Impact: London, contributing 30% to the overall rental supply, plays a disproportionate role in shaping growth rates reported by Zoopla's UK rental index. Zoopla projects a modest 2% growth in London by December 2024, the lowest since 2021.

Regional Variation:

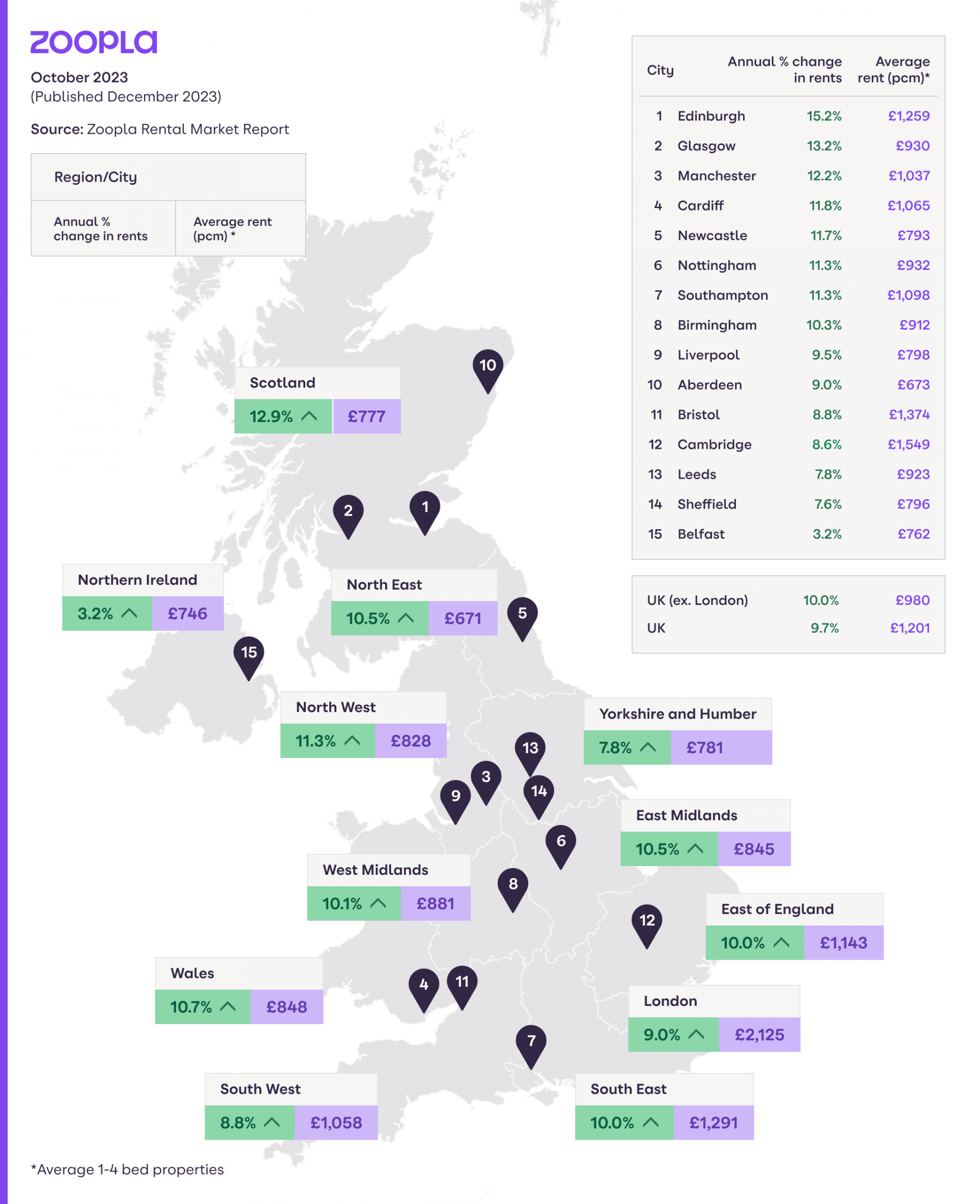

UK rental growth has dropped into single digits, 9.7% from 11.9% a year ago, with London experiencing a more rapid decline from 17% to 9%. In contrast, other regional cities have maintained growth due to better affordability than in the South of England.

Meanwhile, in Scotland there has been a consistent growth with rents up 12.9%, a 1.5% increase in comparison to a year ago. Rent controls implemented in Scotland have resulted in landlords and agents raising rents further for new lets to accommodate for the 3% cap on increasing rent annually.

Four factors driving strong rental demand

Over the past three years there have been four key factors driving the above average demand for rental properties:

- Economic Reopening: The economy bouncing back after mid-2021 pandemic restrictions lifted, including international travel resuming.

- Strong Job Market: The labour market's strength, with job growth increasing the demand for rental homes.

- Higher Mortgage Rates Impact: Elevated mortgage rates making home ownership more costly, keeping potential buyers in the rental market and reducing available homes.

- Immigration Boost: Record immigration, especially among international students, boosting the demand for rental properties.

Weakening Rental Demand

UK rental demand is currently 11% lower year-on-year but remains 32% above the 5-year average. In London, demand has dipped by 20% year-on-year but still exceeds the 5-year average.

The supply-demand imbalance in the rental market is expected to persist in 2024, but there's an anticipation of gradual improvement compared to the last three years.

Rental Prices Exceeding Expectations in Certain Regions

The reduction in asking rents for rental listings is a key indicator of underlying demand and a driver for rental growth is the extent to which asking rents are being reduced to attract more interest.

Notably, in London, 10% of rental listings experienced reductions exceeding 5% in November 2023, while across the rest of the UK, this proportion surged to 7%, marking the highest level in over five years.

This shift is clear evidence of resistance to the upward trend in rents observed over the past three years, reflecting heightened affordability pressures and a moderation in earnings growth. These reductions are distributed evenly across the market by rental price band, with a notable concentration in the £1,000-£1,500 per month bracket.

Zoopla’s Outlook for 2024:

- The rental market shows signs of cooling after a heightened three-year period, with an anticipated slowdown influenced by a persistent supply shortage, low new investments, increased regulation, and higher mortgage rates.

- London is expected to lead this slowdown, driven by slower employment growth and affordability pressures. The average London renter household, allocates 40.2% of earnings to rent, compared to the UK average of 28.4%.

- In regional housing markets, Zoopla anticipates rental growth to outpace earnings growth in 2024, with rents expected to rise by 5-8%, primarily due to underlying scarcity and available headroom in rental affordability.

In a dynamic market, finding the right mortgages for your properties is crucial. Connect with our mortgage consultants at 01628 564631 or contact us for personalised assistance.

The information contained within was correct at the time of publication but is subject to change

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Source: Zoopla UK Rental Market Report – December 2023