Zoopla – January 2024 House Price Index Overview

2024 begins with a rebound in sales market activity

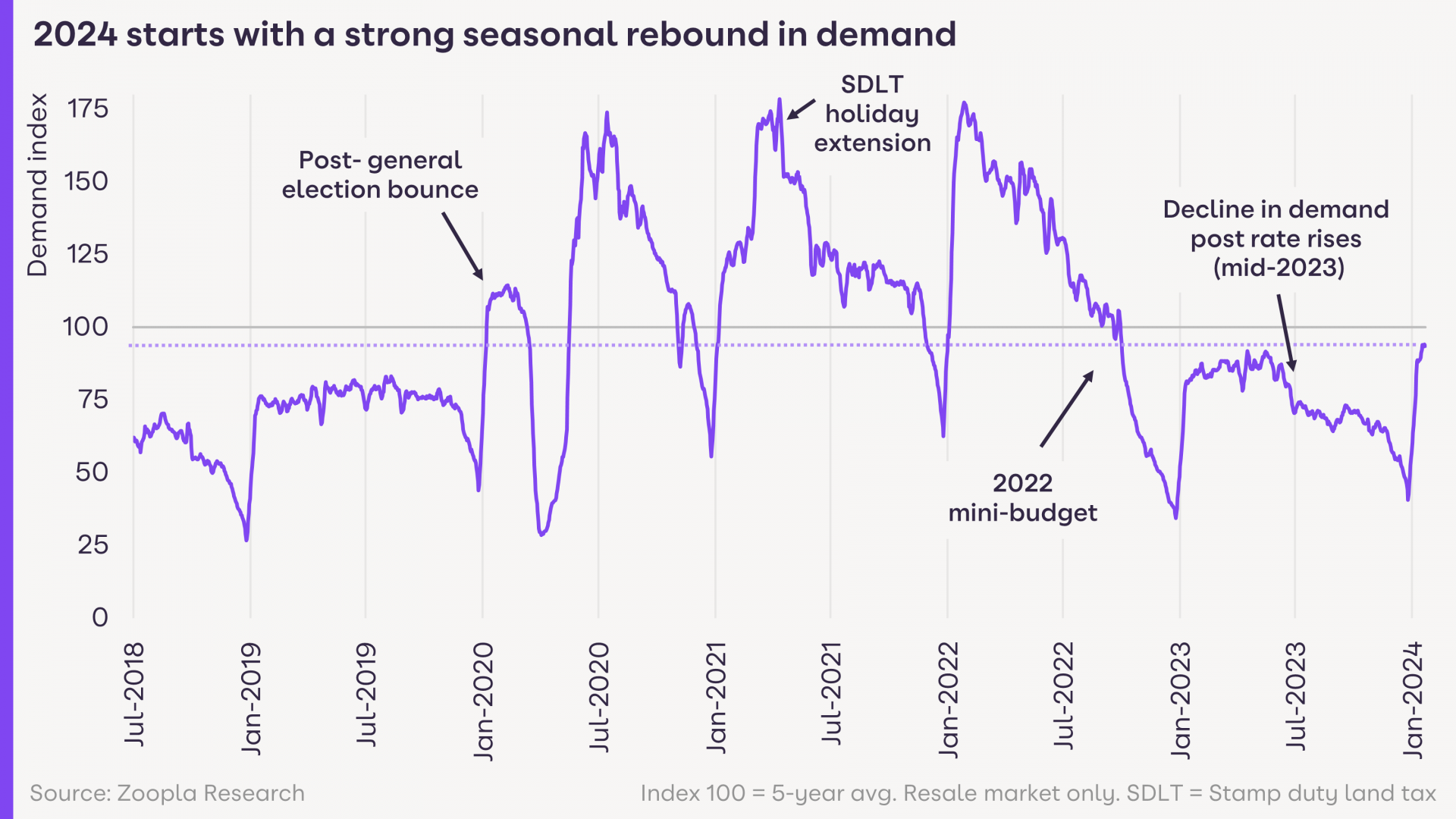

There is a positive start to 2024 as we see an increase in buyer demand of 13% year-on-year within the first three weeks of January. The increase in buyer demand and sales agreed has been supported by the increase in availability of sub-5% mortgage rates. With this decrease in interest rates, the pent up demand of a slow second half of 2023 where many prospective buyers were put off buying are finally starting to move forward with the intention of buying their new home.

Year-on-year, all sales activity shows an increase

Zoopla research reported an increase in sales agreed within the final weeks of 2023 and shows that this trend has continued into the new year, with a 13% increase on new sales agreed compared to this time last year. Regionally, Yorkshire and the Humber have seen the greatest increase in sales with the West Midlands not far behind with +19% and +17% respectively.

This upward trend evidence that buyers and sellers are becoming more aligned with pricing. It also shows the newfound buyers’ confidence in the market. Overall supply is 22% higher than last year.

As more sales are agreed the rate of annual price falls slow

Improved market conditions, driven by increased sales, are stabilizing prices. Zoopla’s UK house price index shows a shift from a -1.4% decline in October 2023 to -0.8% in December 2023. House prices are adjusting to higher mortgage rates, with notable declines in the East of England (-2.5%) and the South West (-2.2%), while Northern Ireland saw a 3.2% increase in 2023.

What is happening in London’s housing market?

- Increased Buyer Demand – London and the East of England are leading the rebound in new buyer demand as we start 2024.

- Uniform Rebound Across Segments – The resurgence in London's housing market spans across various segments, including inner-London, suburban outer-London, and core commuter areas, indicating a potential turnaround.

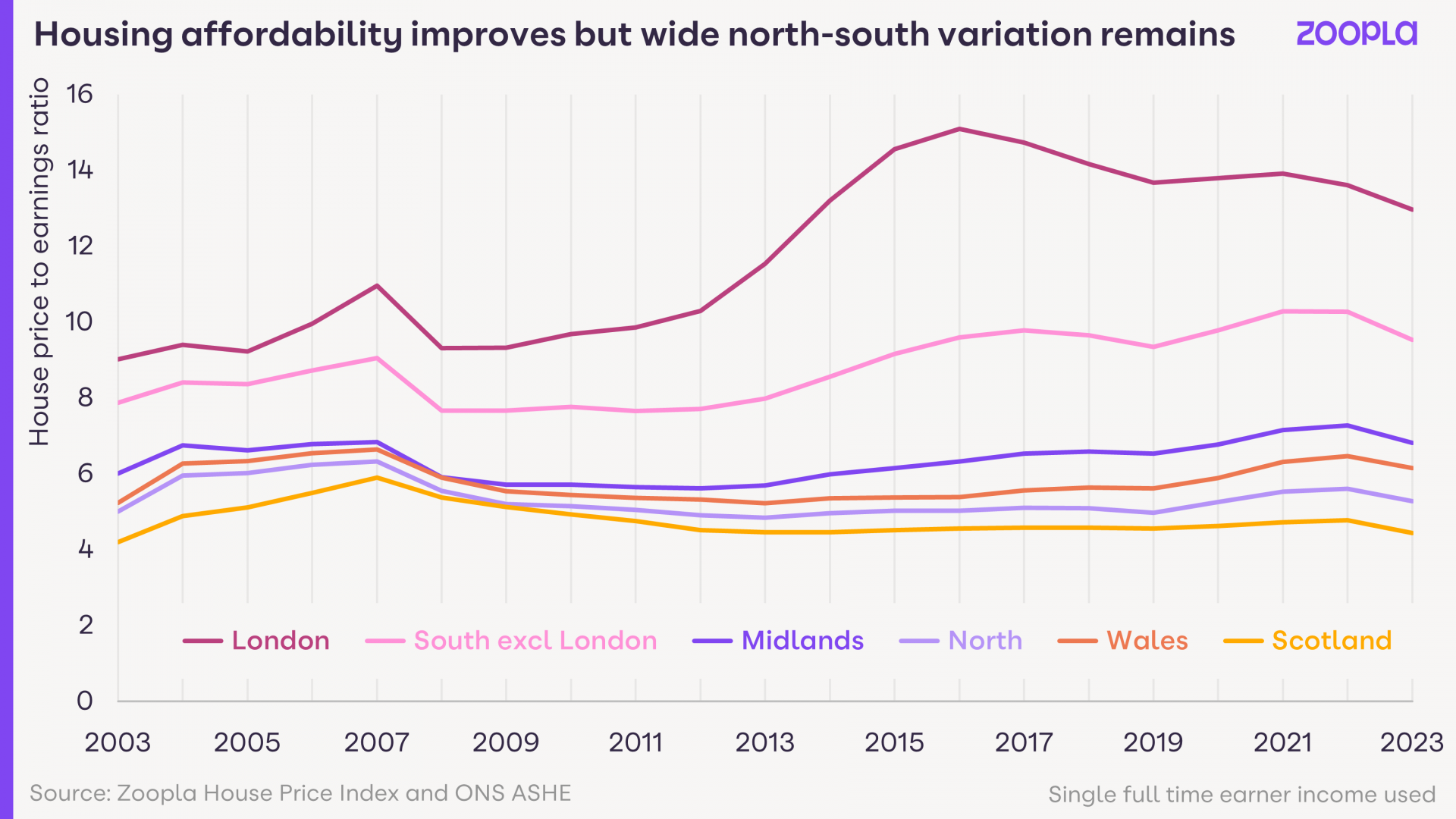

- Modest Price Growth – Zoopla’s house price index shows that house prices have only risen by 13% since 2016 and the average flat has only increased by 2%. In contrast there has been a 34% increase across the entire UK and almost a 50% increase in Wales during the same period.

- Factors Affecting Pricing and Demand – After fast appreciation during the early 2010s, London reached a “peak unaffordability” with a price to earnings ratio of over 15x. Various factors such as tax changes, Brexit, and the global pandemic have impacted demand and pricing in London, along with higher mortgage rates affecting expensive housing markets the most.

- Improving Affordability – Though London remains expensive with a price to earning ratio of 13x, low house price inflation and rising earnings has made it more affordable to live in the capital with this earnings ratio at the lowest since 2014.

- Continued Improvement Expected – Market conditions are expected to continue improving throughout 2024 as earnings are set to outpace house price inflation. Though mortgage rates will still be a limiting factor.

Buyers’ Market

- Caution Optimism – Though there is a positive rebound in activity during the early weeks of 2024, it is important to note caution against projecting this trend to continue throughout the year.

- Effect of Mortgage Rates – he reduction in mortgage rates to 4.2% in Q1 2023 positively impacted sales volumes, resulting in firmer pricing and modest declines throughout 2023. Similar support is expected in 2024, primarily benefiting sales volumes rather than influencing prices.

- 3 Key Factors Keeping Price in Check –

- Increased supply of homes for sale providing buyers with more options, especially for larger family homes.

- Many mortgage holders have yet to refinance onto higher rates, ensuring that buyers remain price sensitive.

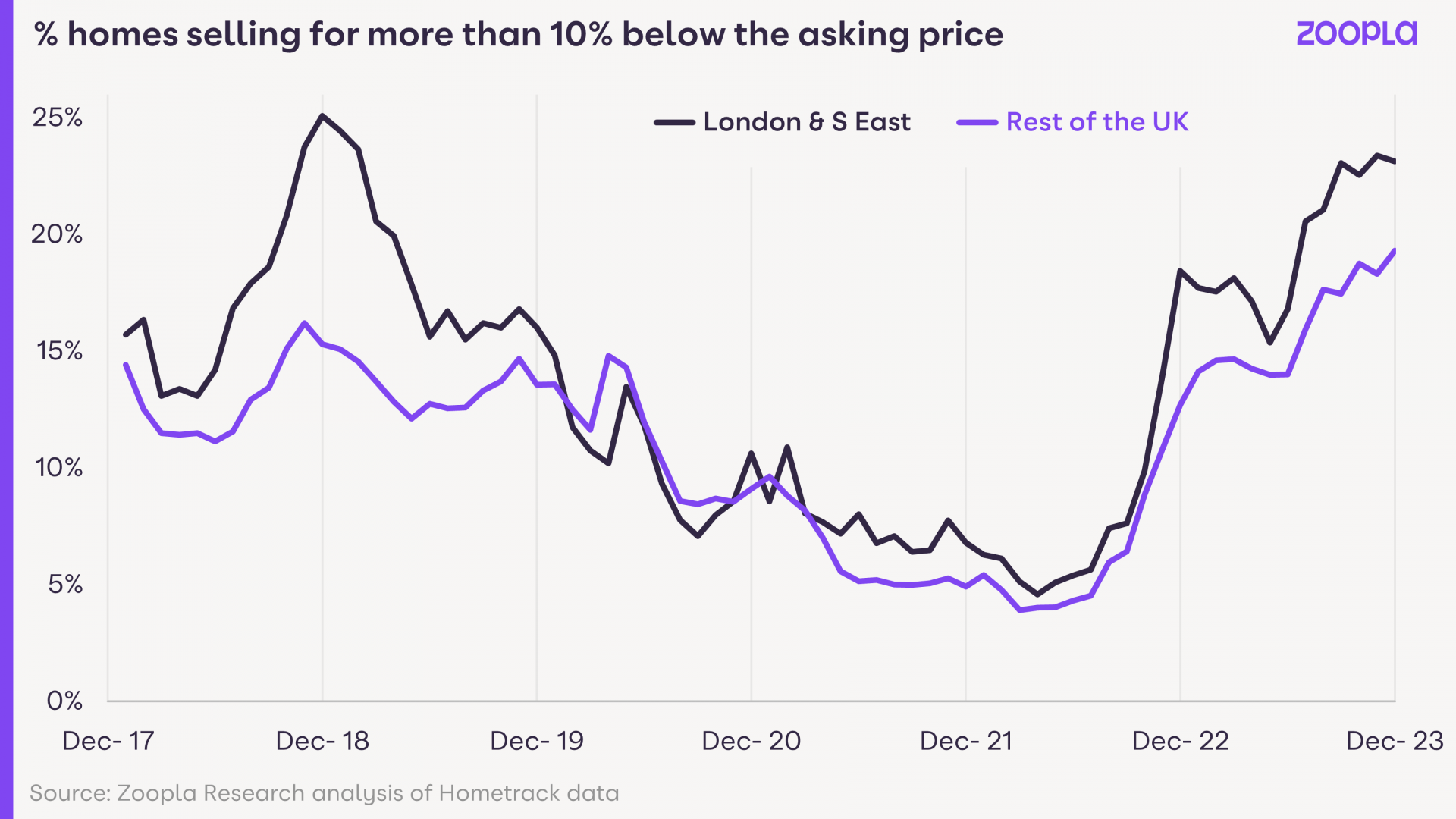

- The market still favours buyers, with over 1 in 5 sellers reducing asking prices by over 10% to attract interest, especially in London the South-East with almost 1 in 5 reducing prices.

- Realistic pricing necessary – Sellers are advised to price their properties realistically if they intend to sell in 2024. While market conditions are improving, expecting higher asking prices may not align with the current dynamics favouring buyers.

Outlook to 2024

Harps Garcha, director at Brooklyns Financial believes: the market is adjusting to the higher mortgage rates, which we are not accustomed to after over decade of low interest rates. While there have been initial reductions from mortgage lenders at the start of 2024, the future remains uncertain amidst the evolving economic landscape.

In a fast-changing market, securing the right mortgages for your properties is crucial. Connect with our mortgage consultants at 01628 564631 or contact us for personalised assistance.

The information contained within was correct at the time of publication but is subject to change

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Source: Zoopla – UK House Price Index January 2024