Positive Signs for the UK Housing Market - July 2024

The UK housing market is currently adjusting to the impact of +4% mortgage rates, as detailed in Zoopla’s House Price Index for July. Positive signs are showing for the UK housing market with increased activity. Over the first half of 2024, house prices have seen a modest rise across the UK, with Zoopla predicting a potential increase of up to 2% by the end of the year.

House Prices: Steady but Slow Growth

Zoopla’s data has shown that over the past 12 months, UK house prices have remained relatively stable, registering a slight increase of 0.1%. This translates to an annual rise of just £310, bringing the average house price to £265,600 as of June 2024. This stability reflects a broader trend of slow but steady price increases observed since January 2024, reversing the declines experienced in 2023.

Zoopla has found different property types have showed varied performance across the housing sector, with, detached houses have seen a slight decrease of 0.6%, while flats have dipped by 0.7%. In contrast, semi-detached and terraced houses have experienced modest increases of 0.7%.

| Average House Price in April 2024 | Average House Price in May 2024 | Average House Price in June 2024 | Year-on-Year Change (£) | Year-on-Year Change (%) | |

| All Properties | £264,800 | £265,400 | £265,600 | +£310 | +0.1% |

| Detached Houses | £447,700 | £447,400 | £449,000 | -£2,750 | -0.6% |

| Flats | £190,900 | £191,000 | £191,700 | -£1,370 | -0.7% |

| Semi-Detached Houses | £270,300 | £270,100 | £271,200 | +£1,910 | +0.7% |

| Terraced Houses | £233,300 | £233,500 | £234,300 | +£1,710 | +0.7% |

Increased Supply and Market Balance

The supply of homes for sale has seen a notable increase, up 16% from the previous year. This surge in supply is enhancing buyer choice and supporting sales growth, helping to keep price inflation in check. A more balanced market is emerging, marked by a steady increase in sales activity without significant price volatility.

One interesting trend is the rise in the number of formerly rented homes entering the market. Approximately 12% of homes for sale were previously rented, a figure that has remained consistent over the past three years. However, Zoopla has found that approximately 40% of these homes stay in the rental market.

Buyer Confidence and Pricing Trends

Buyer confidence appears to be improving, with purchasers now paying a higher proportion of the asking price. As of June 2024, Zoopla have found that buyers are paying 96.8% of the asking price on average, up from 95.6% in October 2023. This trend is particularly pronounced in London and the South East, where the proportion has rebounded to 96.3%, while the rest of the UK has stabilised at 97.1%.

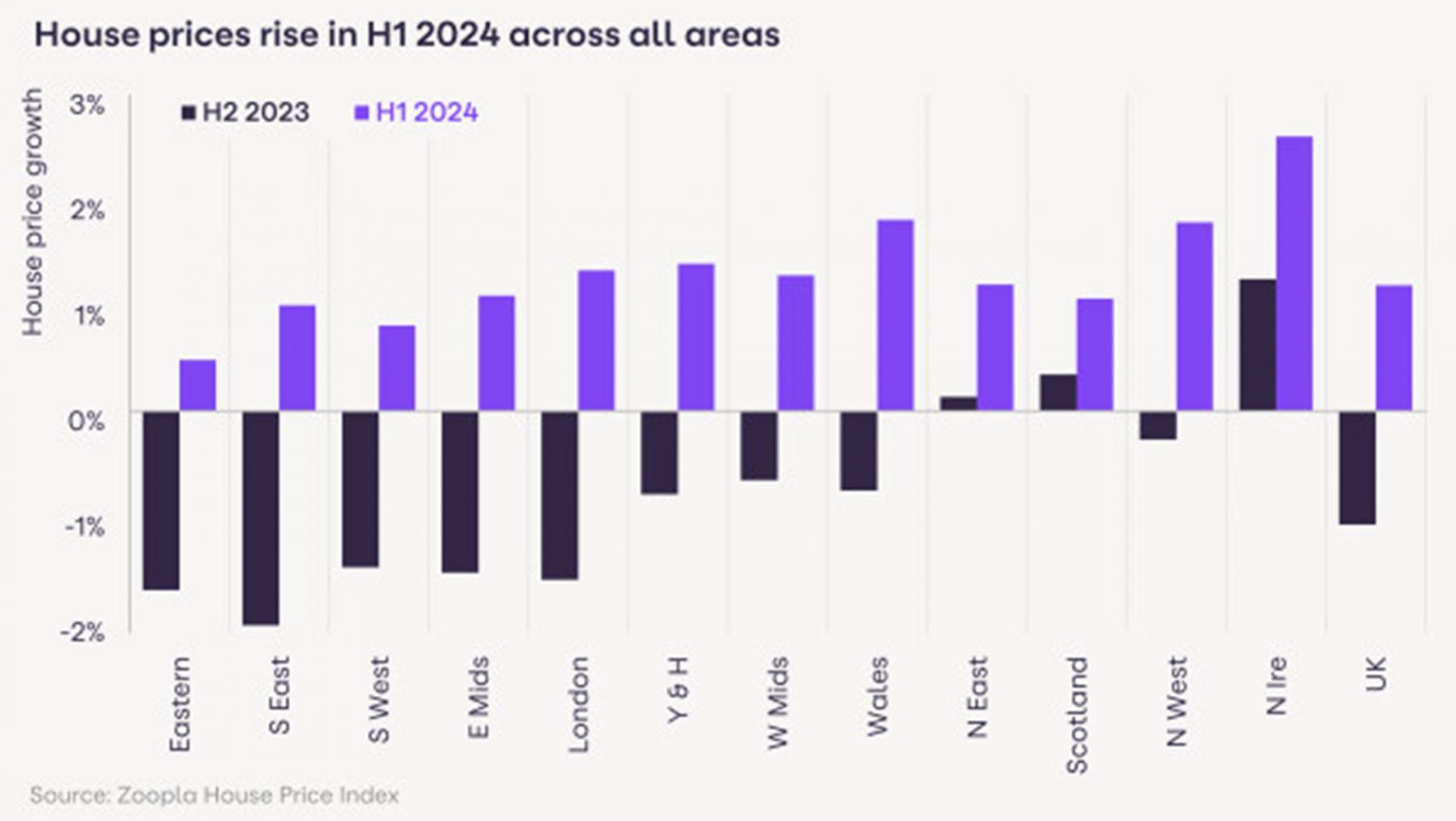

Regional Variations and Future Outlook

While the overall annual house price inflation is a modest 0.1%, regional variations are evident. Northern Ireland has experienced a 3.9% increase in house prices, whereas the East of England has seen a decline of 1.2%.

Looking ahead, Zoopla expect the housing market to continue its gradual upward trajectory, with house prices likely to increase slowly through the remainder of 2024. The annual rate of inflation is projected to approach 2% by year-end. Sales are projected to hit 1.1 million in 2024, though still 10% below the 20-year average.

Long-Term Considerations

For the market to achieve long-term stability and affordability, Zoopla believes it is essential to have a period of 12-24 months where incomes rise faster than house prices. With incomes expected to grow by 4.5% in 2024 and anticipated to outpace house prices again in 2025, the groundwork is being laid for improved affordability.

In conclusion, the UK housing market in 2024 is characterised by steady growth, increased supply, and a more balanced dynamic between buyers and sellers. While challenges persist, particularly in the realm of affordability, the market is showing signs of resilience and cautious optimism for the future.

The Importance of Expert Guidance

Given the ever-changing market conditions, seeking the assistance of a mortgage consultant is more important than ever. With their expertise, you can navigate these fluctuations effectively and find the best possible mortgage options tailored to your needs.

Our experienced mortgage consultants are ready to assist you with personalised guidance every step of the way. For an initial consultation, speak with our experts or call us at 01628 564631. We're here to help you navigate your mortgage journey with informed advice and care.

Take the first step towards securing your mortgage today.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage.

Source: Zoopla