UK Housing Market Shows Resilience and Growth in June 2024

Continued Market Momentum

The UK housing market has shown resilience in the wake of the upcoming election, according to the latest reports from both the Nationwide and the Zoopla UK House Price Indices for June 2024. Despite political uncertainty and broader economic pressures, the market has maintained a steady growth trajectory. New sales agreed are up 8% compared to last year, though there are signs of slowing activity as the summer period approaches.

Stability in House Prices

Nationwide’s data showed stability in the housing market with a continued, yet gradual increase in UK house prices.

- Annual Growth: House prices rose by 1.5% in June compared to the same month last year, reflecting a slight increase from 1.3% in May. This growth leaves prices around 3% below the all-time high recorded in the summer of 2022.

- Monthly Growth: There was a 0.2% increase in house prices from May to June, adjusted for seasonal effects.

- Average Price: The average house price in June 2024 (not seasonally adjusted) was £266,064, up from £264,249 in May.

Sales and Stock Levels

Zoopla found that the recent pick up in the sales market has continued into June, albeit at a slower pace compared to the previous months.

- Sales Agreed: Sales agreed have decreased slightly month-on-month across all regions, with the North East and West Midlands seeing the most significant drops of 6% and 5%, respectively. However, sales agreed are still 8% higher than a year ago.

- Stock Levels: The overall stock of homes for sale continues to grow, although at a slower rate than in recent months. There are nearly 20% more homes for sale than a year ago.

Regional Highlights

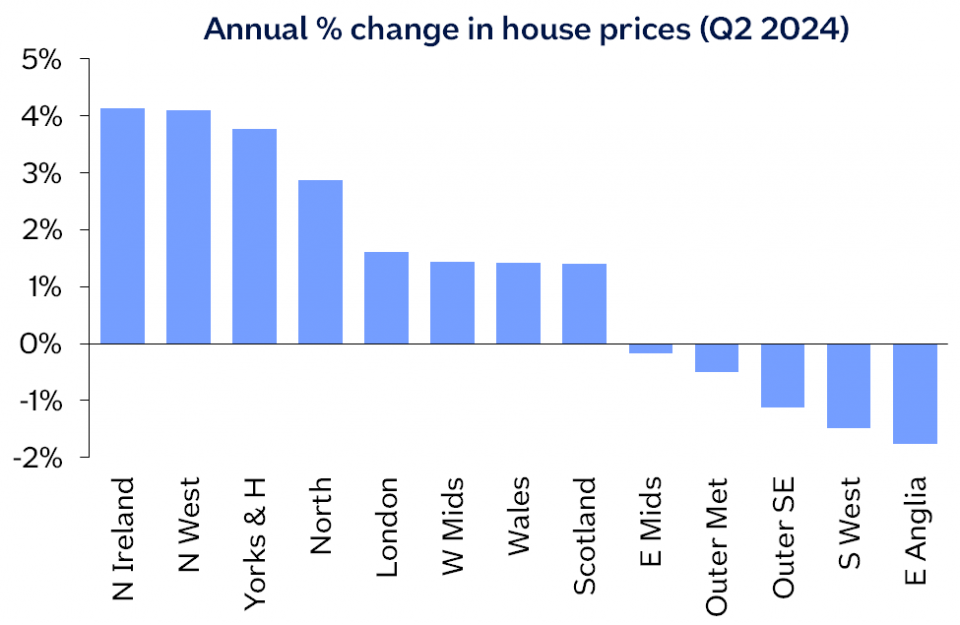

Nationwide’s regional house price indices for Q2 2024 present a mixed picture:

- Northern Ireland: The best-performing region with prices up 4.1% year-on-year.

- Northern England: Outperformed southern England with prices up 2.4% year-on-year.

- Southern England: Experienced a 0.3% year-on-year decline. London was the best performer in this region, maintaining annual growth of 1.6%.

- East Anglia: The weakest performing region with prices down 1.8% over the year.

- Scotland and Wales: Both saw a 1.4% year-on-year increase.

Affordability in the Housing Market

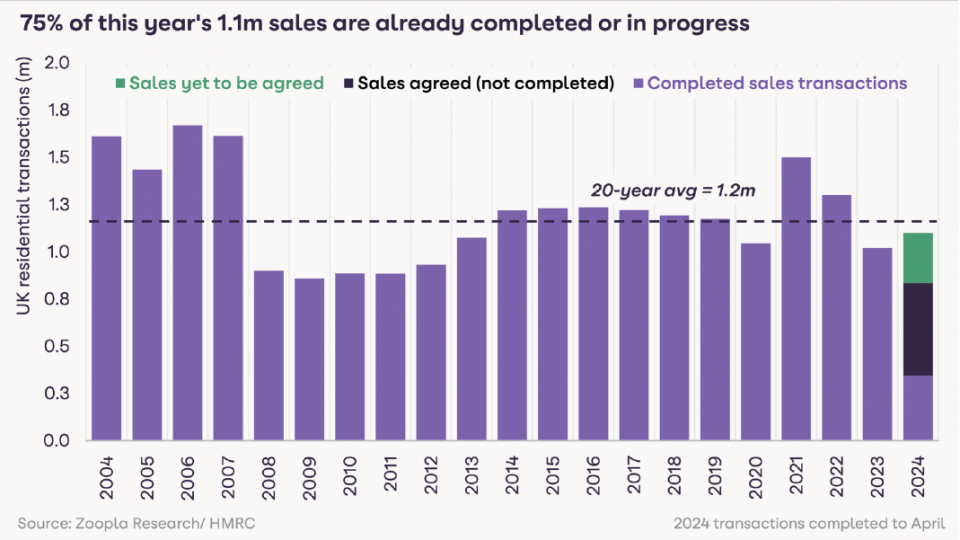

Though house prices are edging up, activity in the housing market remains subdued. Compared to 2019 levels, the total number of transactions is down by around 15%. For transactions involving a mortgage, the levels have dropped by almost 25%, further highlighting the impact of higher borrowing costs. In contrast, cash transactions have increased by approximately 5% in the same period.

Robert Gardner, Nationwide's Chief Economist, noted "While earnings growth has been stronger than house price growth in recent years, higher mortgage rates continue to impact affordability. For example, the interest rate on a five-year fixed-rate mortgage for a borrower with a 25% deposit was 1.3% in late 2021 but has recently been closer to 4.7%. As a result, a borrower on an average UK income buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 37% of take-home pay, significantly above the long-term average of 30%."

Market Outlook

Zoopla’s data projects that the market is on track for 1.1 million sales in 2024, a 10% increase from 2023 but still below the 20-year average. Three-quarters of these sales have either been completed or are in progress, indicating a healthy sales pipeline for the rest of the year. Zoopla forecasts a 1.5% increase in UK house prices by the end of 2024. This positive outlook is partly due to the consecutive monthly price falls over the last six months of 2023 dropping out of the annual growth rate.

Future Predictions

The near-term outlook for the housing market heavily depends on mortgage rates, which are influenced by interest rates. Any reductions in the base rate over the summer and autumn could boost market sentiment and sales activity. Based on economic forecasts, Zoopla believe that mortgage rates will remain between 4-4.5% going into 2025, supporting stable sales volumes and low single-digit house price inflation. However, house prices in southern England are expected to continue underperforming as they realign with incomes.

Conclusion

The UK housing market has demonstrated remarkable resilience, maintaining stability and growth despite the challenges posed by higher borrowing costs and political uncertainty. While affordability remains a concern, the market's performance in the first half of 2024 suggests cautious optimism for the remainder of the year. The ongoing economic conditions, particularly higher mortgage rates, continue to challenge affordability. However, the resilience in certain regions and the overall modest growth indicate that the market is adapting to these pressures.

The Importance of Expert Guidance

Given the ever-changing market conditions, seeking the assistance of a mortgage consultant is more important than ever. With their expertise, you can navigate these fluctuations effectively and find the best possible mortgage options tailored to your needs.

Our experienced mortgage consultants are ready to assist you with personalised guidance every step of the way. For an initial consultation, speak with our experts or call us at 01628 564631. We're here to help you navigate your mortgage journey with informed advice and care.

Take the first step towards securing your mortgage today.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage.

Sources: Zoopla and Nationwide