February Sees an Increase in House Prices and Rental Costs

House Prices Rise by 0.7% in February

According to data from Nationwide’s latest House Price Index, the average house price has risen by 0.7% month-on-month in February to £260,420 from £257,656 in January.

Following this price increase, the annual rate of change has shifted back to positive territory for the first time since January 2023 with prices up 1.2% year-on-year.

Signs of affordability pressures easing

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said, “The decline in borrowing costs around the turn of the year appears to have prompted an uptick in the housing market. Indeed, industry data sources point to a noticeable increase in mortgage applications at the start of the year, while surveyors also reported a rise in new buyer enquiries.

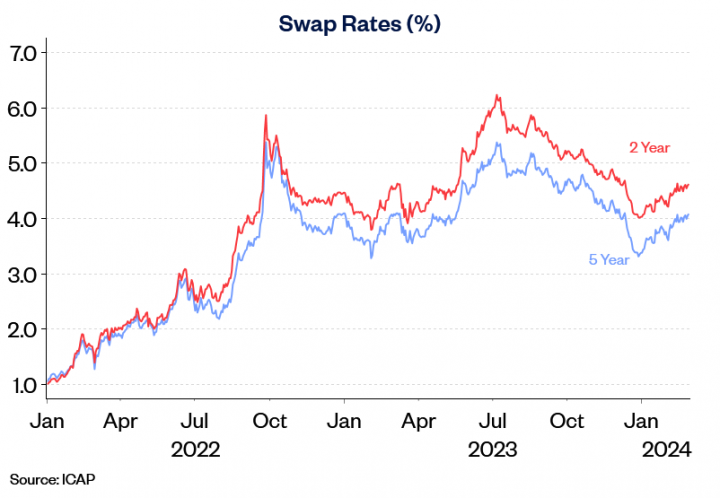

“Nevertheless, near-term prospects remain highly uncertain, in part due to ongoing uncertainty about the future path of interest rates. After falling sharply in late December, swap rates, which underpin fixed rate mortgage pricing, have drifted back up.”

Average rental cost is 7% higher than February 2023

The latest data from Goodlord shows the average rental cost for a property has increased by 7% since February 2023. Month-on-month, average rental costs rose by 1% throughout February, increasing to £1,162.

In February, the average price of a rental property in the South East stood at £1,293, closely trailed by the South West at £1,173.

The largest increases in rent were seen in the South West, with a year-on-year increase of 11%, followed by a 7.5% rise in the North East. Conversely, the West Midlands saw the smallest difference in rent paid with an increase of 4.5%.

While overall rents rose by 1% in England through the month of February, two regions saw a fall in rents. The West Midlands saw a decrease of 2% and Greater London’s rents reduced by 1% on average.

February also saw a reduction in the length of void periods from 22 days in January to 18 days, a decrease of 18%. The North East observed the most significant decrease in void periods, reducing from 24 days in January to 17 days in February, a notable 29% difference. On the other hand, the South East was the sole region that did not witness a change, with void periods holding at 20 days.

William Reeve, CEO at Goodlord, said: “We don’t normally see a bump in rents during February. It’s typically a slower month where things cool off following the post-Christmas release of demand we see in January.

“The fact that we’re seeing a rise this month is indicative of the ongoing squeeze on the market and a lack of available stock – something that’s further evidenced by the shortening of voids across England.

If you are looking to purchase your next home or simply looking for a new deal on your property, it is important to get advice. Speak to one of our experienced mortgage consultants who can help find the best deal for you. Contact our team or call 01628 564631 to book an initial consultation.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage.

Source: Goodlord, Nationwide